EUDR: Donau Soja supports members and partners in implementation

Current EU Deforestation Regulation, or EUDR, status: (ongoing updates)

UPDATE DECEMBER:

The trilogue on 3 December 2024 concluded that the implementation period for the EUDR should be extended by one year to 30.12.2025 (for small companies, application date changed to 30.06.2026).

The European Parliament’s proposal to introduce a “zero risk” category was not adopted. The content of the original version with three risk categories, namely low, standard and high, therefore remains unchanged. The country benchmark, which will classify all cultivation countries into one of these three categories, is to be finalised by the end of June 2025.

UPDATE NOVEMBER:

Before the trilogue, on 14.11.2024, the EU Parliament voted on the extension of the implementation period of the EUDR proposed by the EU Commission and confirmed that the EUDR must be applied from 30.12.2025 instead of 30.12.2024 (for small companies, application changed to 30.06.2026).In addition, the Parliament has proposed the introduction of a new “zero risk” category: For products from zero risk countries, no geolocation data and no due diligence statement is required. This was not adopted however.

Next steps

In order to implement the one-year extension of the legislation, the agreement must be adopted in the plenary session in the third week of December. Another update will follow then.

In addition, the long-awaited new version of the FAQs and the Guidance for EUDR implementation were published. The guidance describes in 11 chapters which due diligence processes companies must introduce and how robust standards like Donau Soja may support the implementation.

With the postponement, companies will gain one year to adapt to the EUDR requirements, especially for low, standard and high-risk countries. This is good news for many companies that are not prepared yet, but also bitter for companies that put already a lot of effort into compliance. In any case, companies still must prepare for the EUDR and Donau Soja continues to offer a solution to show compliance with EUDR requirements – but also for further coming requirements beyond.

From 30 December 2025, first operators and traders of the commodities soya, palm oil, rubber, cocoa, coffee, timber products and cattle on the EU market must demonstrate through a defined due diligence process that their goods were produced deforestation-free (cut-off date 2020) and in accordance with national laws in the country of cultivation, and confirm this via a due diligence statement (DDS). The goods must be traceable back to the field, including geolocation data. Traceability along the supply chain to the field is considered necessary to prove that the soya does not come from recently deforested areas.

As a member of the EUDR Expert Group, Donau Soja has the opportunity to discuss open questions directly with the European Commission and to inform our partners first, to be as well-prepared as possible.

However, the following information is not legally binding and may need to be adjusted in the course of the process as new information from the EU Commission becomes available.

Background of the regulation

The EU imports millions of tonnes of raw materials every year, for which forests are cleared in other parts of the world. Especially for animal feed, we import about 35 million tonnes of soya every year, mainly from South America, where forests and other valuable ecosystems are converted into agricultural land on an unimaginable scale. According to the FAO, 90% of global deforestation is caused by the expansion of agricultural land. Due to the complexity of the global supply chains of so-called bulk commodities, we often do not know where exactly they come from. However, studies show that the EU is the second-largest cause of global deforestation. This is where the EUDR comes in: The complex supply chains are to be disentangled, so that we can exclude recently deforested areas from EU supply chains and only buy from farmers who do not clear forests.

Cut-off date for deforestation

The cut-off date for deforestation in the EUDR was defined as 31 Dec 2020. This means that areas that have been deforested since 1 Jan 2021 will be excluded from the EU supply chains.

The EUDR goes even beyond the legislation in the countries of cultivation: Even areas that have been legally deforested in the country of cultivation after 31 Dec Jan 2020 are excluded.

Small and medium-sized enterprises

Small businesses must apply the EUDR from 30 Jun 2026.

SME traders may only make relevant products available on the market if they document information on buyers and sellers, including reference numbers of the former DDS, and store them for five years. If a DDS already exists for a relevant product, SMEs do not have to complete the whole due diligence process but only have to pass on the reference numbers of the existing DDS.

Small companies is defined as not exceeding more than one of the following three criteria (based on EU Directive 2013/34/EU – Article 3):

- Balance sheet total: EUR 4,000,000 / Net turnover: EUR 8,000,000 / Average number of employees: 50

Medium-sized enterprises do not exceed more than one of the following three criteria:

- Balance sheet total: EUR 20 000 000 / Net turnover: EUR 40 000 000 / Average number of employees: 250

Checks and penalties

The competent authority of each EU member state is responsible for checking the respective imports and exports to and from the country. For imports from low-risk countries, 1% of relevant goods and operators are to be checked each year, for standard-risk countries 3% and for high risk countries 9% of operators and goods.

Penalties can be up to 4% of the company’s turnover in the EU. In addition, companies can be temporarily excluded from public tenders or banned from placing relevant products on the market.

Timeline

June – August 2024

- New Website on Due Diligence Registry, API Testing, Training videos and timelines

- API Test started

- GeoJSon Test started

September 2024

- Trainings on Due Diligence Registry started

October 2024

November 2024

- Companies can register in Due Diligence Registry

December 2024

- 3rd: Trilogue between European Commission, Parliamant and Council agreed to extend the implementation period until 30.12.2025

- 4th: The Due Diligence registry was opened for submission of due diligence statements.

June 2025

- Country benchmarking to be published

December 2025

- 30 Dec: Companies must apply EUDR requirements

June 2026

- 30 Jun: Small companies must apply EUDR requirements

Page Navigation

How to prepare

When getting prepared for the EUDR you have to consider the following aspects:

1) Is your company small, medium, or non-SME?

2) Analyse your supply chain

Do you purchase relevant products? (see Annex 1 or “Which soya is covered by EUDR” below)

If so

– What information about these products do you have already?

– What information is missing? (Gap analysis see Article 9 EUDR or “Information collection” below)

– Where do I get the products from? (suppliers, countries..)

– What are the risks?

– What do I do or can I do to mitigate the risks?

3) Establish a timetable for the changes needed in your company.

This could include:

– Action plans towards EUDR compliance

– Involving suppliers – What do my suppliers know/do?

– Prepare IT system and look into API testing

– Analyse what tools and certifications are available and fit for your purpose

Helpful links for further information

EUDR Text available in all EU languages:

Information on the Due Diligence Registry:

Information of European Commission on EUDR Implementation incl. FAQs:

Information on Information System & API Testing (Application Programming Interfaces):

Online tool for Geocoordinates:

Information on EUDR Implementation in German:

FAQs in German:

Information on TRACES = EU platform for imports of animals & food products, incl. EORI

Information on EU Single Window = Platform to connect custom & non-custom IT systems

The Role of EU Farmers and Companies

According to the rules of the World Trade Organization (WTO), no special rules for one’s own market may be enacted. Therefore, the requirements of the EUDR also have to be implemented for relevant products grown in the EU. Article 13 – simplified due diligence – allows a simplified due diligence process for products from low-risk countries, which should apply to most EU and European countries (the official risk classification of the countries by the EU Commission is expected by June 2025). Thus, EU farmers and companies using European soya, and due to shorter supply chains, can expect less additional effort compared to imports from high-risk areas.

The first due diligence process and the completion of the first DDS always lie with the first market participant located in the EU who makes the goods available on the market. Companies outside the EU cannot issue a DDS. Subsequently, every company buying and selling relevant products in the EU must fill out a DDS, based on the previous DDS’s.

Soya farmers in the EU are the first operators of the soya and thus responsible for ensuring the legality and deforestation-free production of the soya as well as completing the DDS. However, it will be possible to authorise the next level of the supply chain to fill in the DDS (e.g., the storage facility or cooperative).

For EU farmers, the EUDR requirements may vary slightly between member states, but the overall aim is consistent across the EU. For example, the German Ministry of Agriculture (BMEL) has outlined specific guidelines for German farmers:

What specific obligations do agricultural businesses in Germany have?

German farmers are primary producers, they are at the very beginning of the supply chain and generally only have small farms (SMEs). They have therefore already fulfilled the requirements of the EUDR if they submit a due diligence declaration once a year in the European Commission’s information system. This will give them a reference number that they will pass on along the supply chain with their goods. The companies already have almost all the information required for such a declaration as part of their day-to-day commercial activities – for example, lease agreements. They can prove that they have complied with the EUDR on their land at any time. The only new requirement is to provide information about the areas using geolocalisation coordinates.

- The following applies to primary producers in Germany: They do not have to introduce a due diligence system on the farm but must record their production areas using geolocalisation coordinates.

- The only obligation, for example for a small cattle farm, is to upload a due diligence declaration in which this geodata is specified. This must be done once a year on the basis of existing planning data.

- All information that may be required in the event of an inspection under the Regulation is usually available on the farm, for example in the form of a purchase or lease agreement. In case of doubt, the cultivated area as recorded in the land register, for example, can serve as proof of compliance with the regulation.

As is usual when implementing a new, comprehensive regulation, regular discussions are still taking place between the EU Commission and the member states as well as between the federal government and the federal states on the exact interpretation of individual points. The Federal Office for Agriculture and Food (BLE) and the Federal Information Centre for Agriculture (BZL), which is based there, will provide information on the results of these meetings as soon as possible. Future information will include German translations of further official FAQs from the EU Commission as well as guidelines on the application of the regulation. These will also contain application examples for domestic primary producers.

A summary of the information on the EUDR for dispatch to affected companies can be found here:

Which Soya is covered by the EUDR

Annex I of the EUDR defines the products to which the due diligence obligations apply (see box below).

DDS If a new product is produced that is listed in Annex I, e.g. the processing of soya beans into soya oil, a new DDS must be completed with the data of all soya that has been used.

The due diligence obligation for soya in animal feed, for example, ends when the soya has been consumed (with the exception of cattle, as cattle itself is listed in Annex I of the EUDR).

What does soya mean here?

Annex I of the Deforestation Regulation defines which products are covered and can be compared using the customs numbers:

- 1201 Soya beans, whether or not broken

- 1208 10 Soya bean flour and meal

- 1507 Soya bean oil and its fractions, whether or not refined, but not chemically modified

- 2304 Oilcake and other solid residues resulting from the extraction of soya bean oil, whether or not ground or in the form of pellets, resulting from the extraction of soya-bean oil

The Due Diligence Process

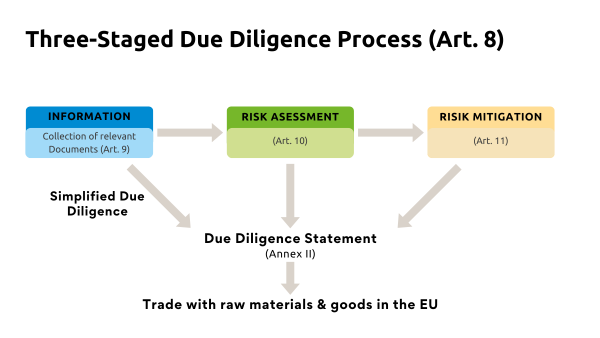

First distributors on the EU market and large companies in the EU must use a three-stage due diligence process to ensure that their supply chains comply with the regulation and confirm this via the upload of a DDS.

Most EU and European countries are likely to be classified as low risk. This leads to a so-called simplified due diligence process, which only consists of collecting information and does not require any risk assessment or mitigation. This means less bureaucracy for domestic soya.

Information Collection

The following information must always be collected and stored for five years according to the EUDR (Articel 9 Information requirements):

Trade name and type

Quantity

Country / region of cultivation

Geolocation of all plots of land where the commodity was grown

Production- / harvest-date

Proof of legal compliance

Proof of deforestation-free cultivation

Name, address and e-mail address of company from whom and to whom the relevant products have been supplied (seller and customer)

Due Diligence Statement (DDS)

Before placing relevant goods on the EU market or exporting them, a DDS must be uploaded to a new EUDR Information System. Only then the goods may be traded.

Information that must be included in the DDS (Annex II):

Name and address of the market participant (including EORI number if applicable)

If applicable: reference numbers of existing DDS’s (e.g. when processing soya beans into oil)

Trade name and type

Quantity

Country/ region of cultivation

Geolocation data of all plots of land where the relevant commodity was grown

Confirmation that the due diligence process has been applied and that the product is low risk

When is a DDS required?

Whenever affected soya products are made available, traders must ensure that the relevant information is passed on as part of the DDS.

When processing relevant products, e.g. soya beans into soya oil, a new DDS must be created with the information from all previous DDS’s.

The European Commission has yet to define when this should be done for ongoing processes.

The Role of Donau Soja

Certified goods do not automatically guarantee compliance with the EUDR. Article 11 – Risk Mitigation – mentions on-site audits and certification as an option for risk minimisation, but they do not relieve from the due diligence process or liability.

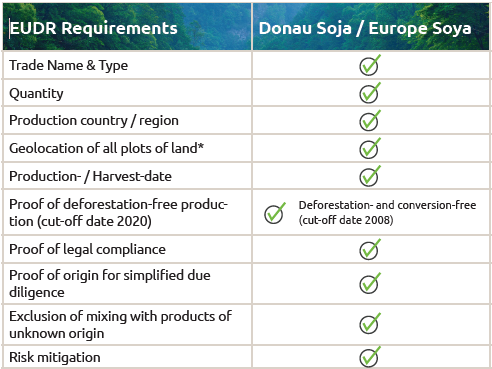

With Donau Soja / Europe Soya certified soya, it is ensured that the soya is deforestation- and conversion-free, with the cut-off date 2008, and produced in accordance with national legislation. Thus, the requirements of Donau Soja / Europe Soya are stricter than the EUDR requirements.

It is planned that farmers can provide all relevant information for the DDS as part of the Donau Soja self-declaration and the information will be passed on in our database and along the supply chain if desired. Donau Soja can thus provide the necessary information and facilitate the process for companies using Donau Soja / Europe Soya certified soya. The creation of the DDS must be done by companies themselves. The responsibility and liability remain with the companies that buy/sell relevant products.

Geolocalisation data

The geo-coordinates of all cultivation areas must be collected as part of the information collection and DDS, regardless of whether the product originates from low, standard or high-risk countries.

Additional requirements for farmers will mainly consist of collecting and sharing the geolocation data of all fields where soya has been grown.

An easy way to find out the geo-coordinates is to use digital online map services, such as Google Maps or similar programmes, and click on the relevant location. Attention: When using Google Maps coordinates, the order of longitude and latitude must be reversed because the EUDR system uses the opposite sequence compared to Google.

By simply clicking on the corresponding location, a marker is set (see red marker in graphic 2 on the right) and information about the location including the geo-data is displayed (see highlighted figures in yellow in graphic 2 on the right).

It will probably also be possible to enter all of a farmer’s areas, regardless of whether soya was grown there in the respective year (so-called “Declaration in Excess”). This simplifies the process in subsequent years if soya is grown on a different section of land of the farmer.

Geodata requirements

- Field area under four hectares: one geo-point is sufficient (this simplifies EUDR compliance for small farms )

- More than four hectares: polygon information required (one geo-point for each corner of the plot)

- If soya is grown on multiple fields: all plots of lands must be specified, depending on their size either with one geo-data point (<4 hectares) or polygon (>4 hectares)

- Accuracy: six decimal places must be provided for each geo-point

What is missing?

1. Scope

In terms of content, one of the biggest shortcomings is that land conversion of other sensitive ecosystems is not covered by the regulation. The EUDR already stipulates that there should be reviews and proposals for expansion. The first reviews in 2025 and 2026 include the topics of including “other wooded lands and ecosystems”, other raw materials such as maize, and the inclusion of financial institutions. After five years, the impact on trade, especially on small farmers, and possible trade facilitation measures will be reviewed. A thorough impact assessment would have been needed before the regulation came into force. Whether or not the regulation will be amended depends on the outcome of the respective review and the European Commission then responsible.

2. Sustainable Soya

Sustainable soya cultivation must take into account further issues such as the reduction of CO2 emissions, pesticide and fertiliser reduction, water management, soil management, protection of biodiversity, GM-free, varied crop rotations (no monocultures) and compliance with human and labour rights. Compliance with the EU Deforestation Regulation alone does not ensure sustainable supply chains. Strict cultivation standards that take these issues into account therefore remain an important tool for making EU supply chains more sustainable.

Why should landscapes other than forests be protected?

In Brazil, for example, most land conversion for new agricultural land takes place in the Cerrado, the world’s most biodiverse savannah. The Cerrado is also extremely important for the water cycle in South America and interacts closely with the neighbouring Amazon rainforest. However, the largest parts of the Cerrado do not fall under the forest definition of the EUDR, hence are not protected under the regulation. Deforestation rates in the Amazon have fallen significantly under the new Brazilian government since the beginning of 2023 – but record areas are still being converted to agriculturar land in the Cerrado.

For more information contact us at sustainability@donausoja.org.